TRUSTED CREDIT REPAIR: Allow The Experts To Handle Your Needs.

We Help Clients

"Erase Debt & Build Freedom"

Get Started Today and See Results in

30 Days or Less.

We Specialize In Helping People To Eliminate Thousands Of Dollars Worth Of Debt Off Your Credit Report

We Also Offer the Most EFFECTIVE And RAPID Credit REPAIR

We Apply Consumer Law to

Eliminate Common Credit Report Errors Like:

We Use The Power of The Law to Remove Common Credit Report Errors Like:

Late Payments

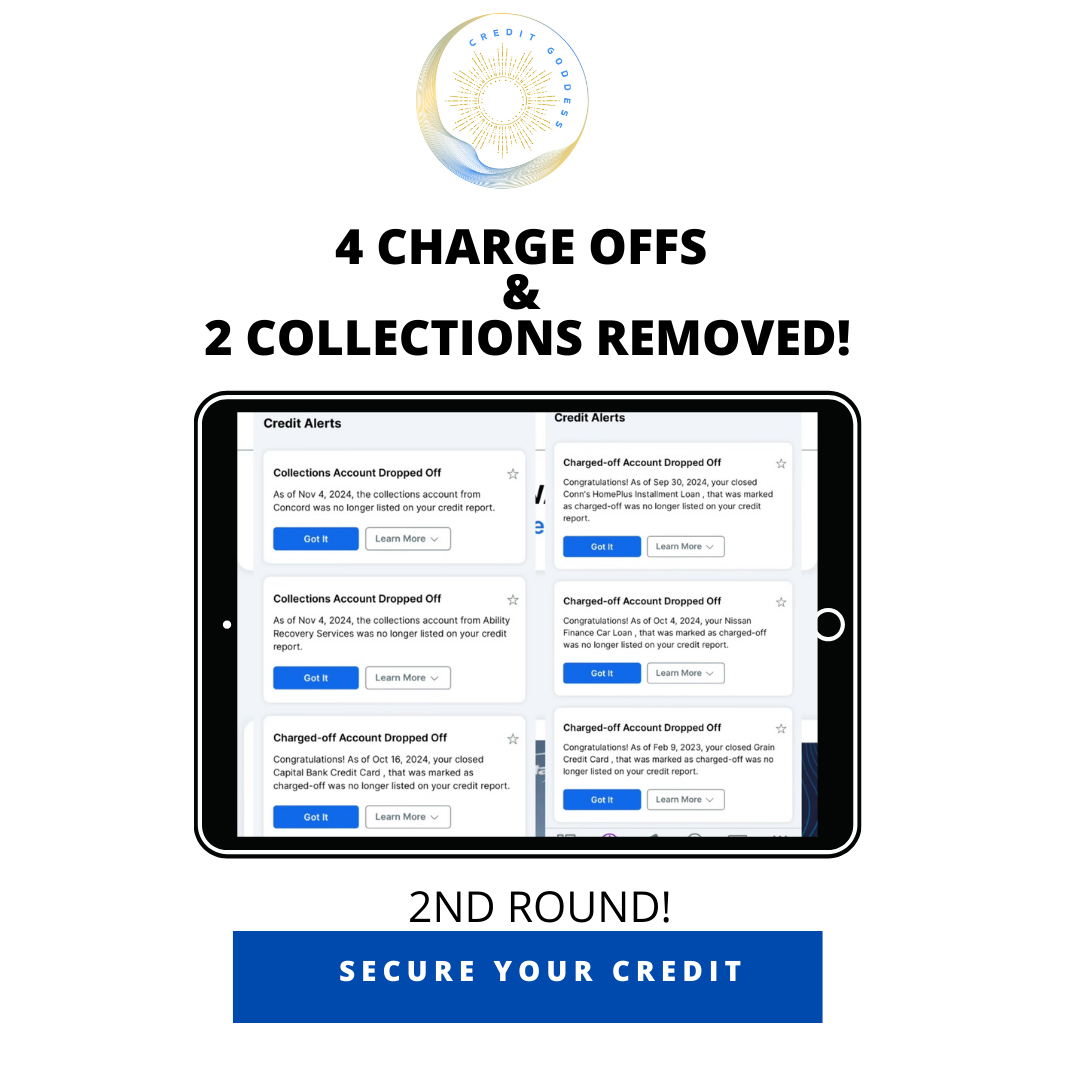

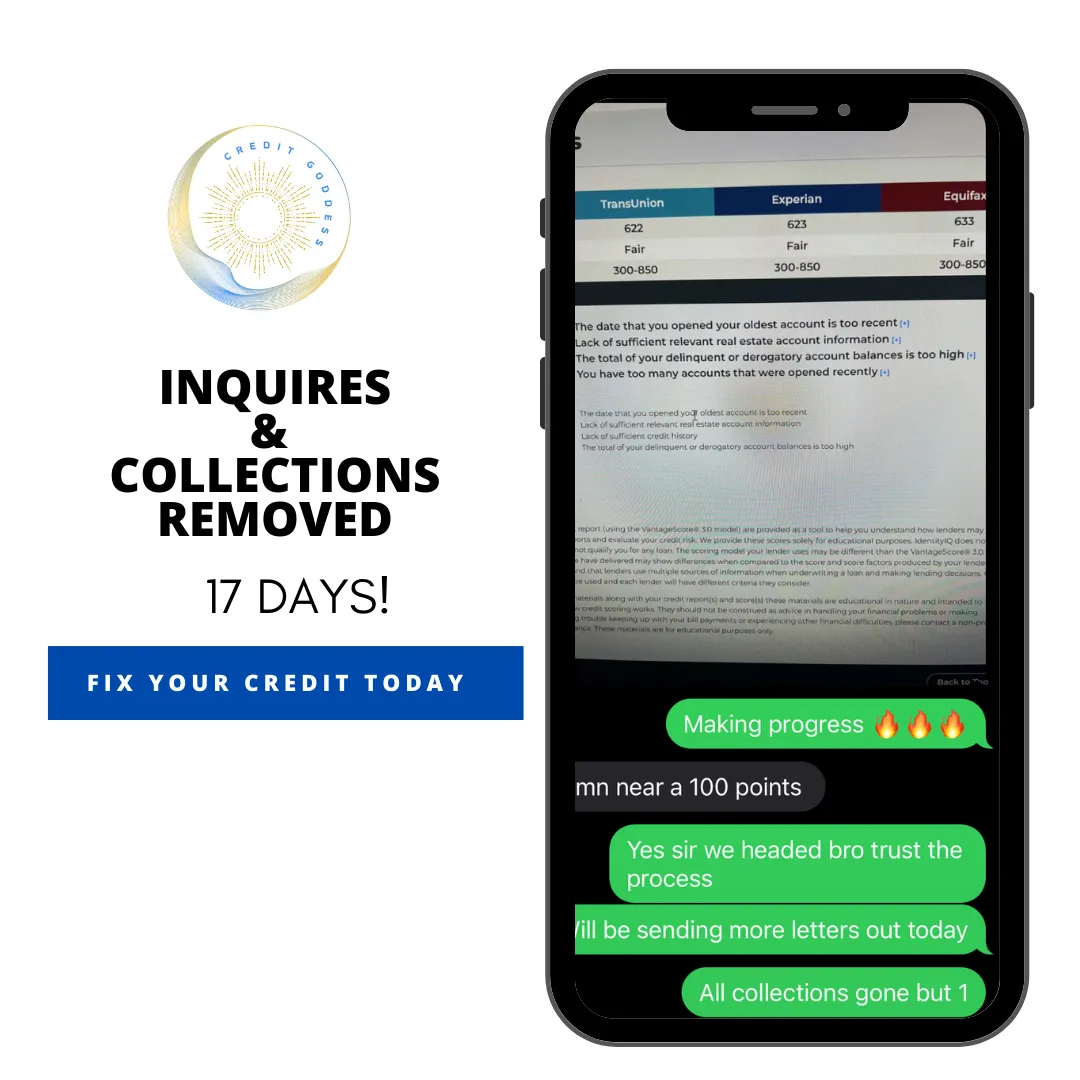

Collections

Hard Inquiries

Charged-Offs

Bankruptcies

Student Loans

Judgements

Repossessions

Foreclosures

And Much More...

- Late Payments

- Collections

- Hard Inquiries

- Charged-Offs

- Bankruptcies

- Student Loans

- Judgements

- Repossessions

- Foreclosures

- And Much More...

Here Is How We Handle Your Credit Journey.

- Step 1: Credit Analysis

Credit analysis provides insight into areas of improvement and

allows us to formulate a plan to boost your score. We review your report for outstanding debts, payment history, credit history, Credit Utilization and inaccuracies. It provides the foundation for a tailored credit repair strategy just for you.

- Step 2: Dispute

We work with all 3 credit bureaus and your creditors to dispute the unfavorable marks, outdated and misreported information on your report that affect your credit score using our legal team.

- Step 3: Track Progress

Regularly reviewing key milestones to assess how well goals are being met for improvement, effective actions and to ensure progress is continued in the right direction. You can see your client portal 24/7 for live status updates on improvements on your credit report.

- Step 4: Credit Restoration

The goal is to ensure a focused effort to remove all negative items and restore and rebuild your financial Access to a better way of living. We will do our best to maximize your results using our custom tactics on the bureaus so you can achieve financial freedom.

- Step 1: Credit Analysis

Credit analysis provides insight into areas of improvement and allows us to formulate a plan to boost your score. We review your report for outstanding debts, payment history, credit history, Credit Utilization and inaccuracies. It provides the foundation for a tailored credit repair strategy just for you.

- Step 2: Dispute

We work with all 3 credit bureaus and your creditors to dispute the unfavorable marks, outdated, misreported information on your report that affect your credit score using our legal team.

- Step 3: Track Progress

Regularly reviewing key milestones to assess how well goals are being met for improvement, effective actions and to ensure progress is continued in the right direction. You can see your client portal 24/7 for live status updates on improvements on your credit report.

- Step 4: Credit Restoration

The goal is to ensure a focused effort to remove all negative items and restore and rebuild your financial Access to a better way of living. We will do our best to maximize your results using our custom tactics on the bureaus so you can achieve financial freedom.

Here are some Frequent asked Questions

Credit Repair is actually the process of removing inaccurate, unfounded, out of date, false, and erroneous information from your credit report. Your credit report dictates your credit score. The 3 major credit bureaus collect information from lenders, creditors, and debt collectors and apply it to your credit report. Based on that information, your credit score is determined. This information could include the balances on loans or credit cards, credit inquiries, debt to income ratio, and most importantly, credit utilization (the percentage of debt you have to available credit)

Can You Remove Anything From My Credit Report?

We can only fight to remove any items that fall under the guidelines of the FCRA. These are items that should be removed due to being inaccurate, unfounded, out of date, false and/or erroneous.

How Much Does It Cost?

The price varies depending on what you have on your credit report. To get a proper estimate, please book a FREE Consultation + Credit Analysis Appointment with a credit expert by clicking the Button below:

Is Credit Repair Legal?

Yes, credit repair is legal & we use the law in your favor. That law is called "The Fair Credit Reporting Act." The FCRA gives you the right to dispute any item on your credit report. If that item cannot be verified within a reasonable time (usually 30 days) it must be removed. Studies have shown that 79% of all credit reports contain errors. This is nearly 8 out of 10 reports. Therefore most credit reports improve immediately. For items that disputed that are not errors, a creditor or furnisher is often unable to find the records or signed documents within the allotted time and the item gets removed. Sometimes the furnisher will say it has been verified by not offer proof. It is our job to prepare documents that challenge this and we are very skilled at that.

Copyright 2022

All rights reserved.

REFUND POLICY